IRS to Overhaul Its Tech After Finding $21.1 Billion in Fraud in Just Two Years

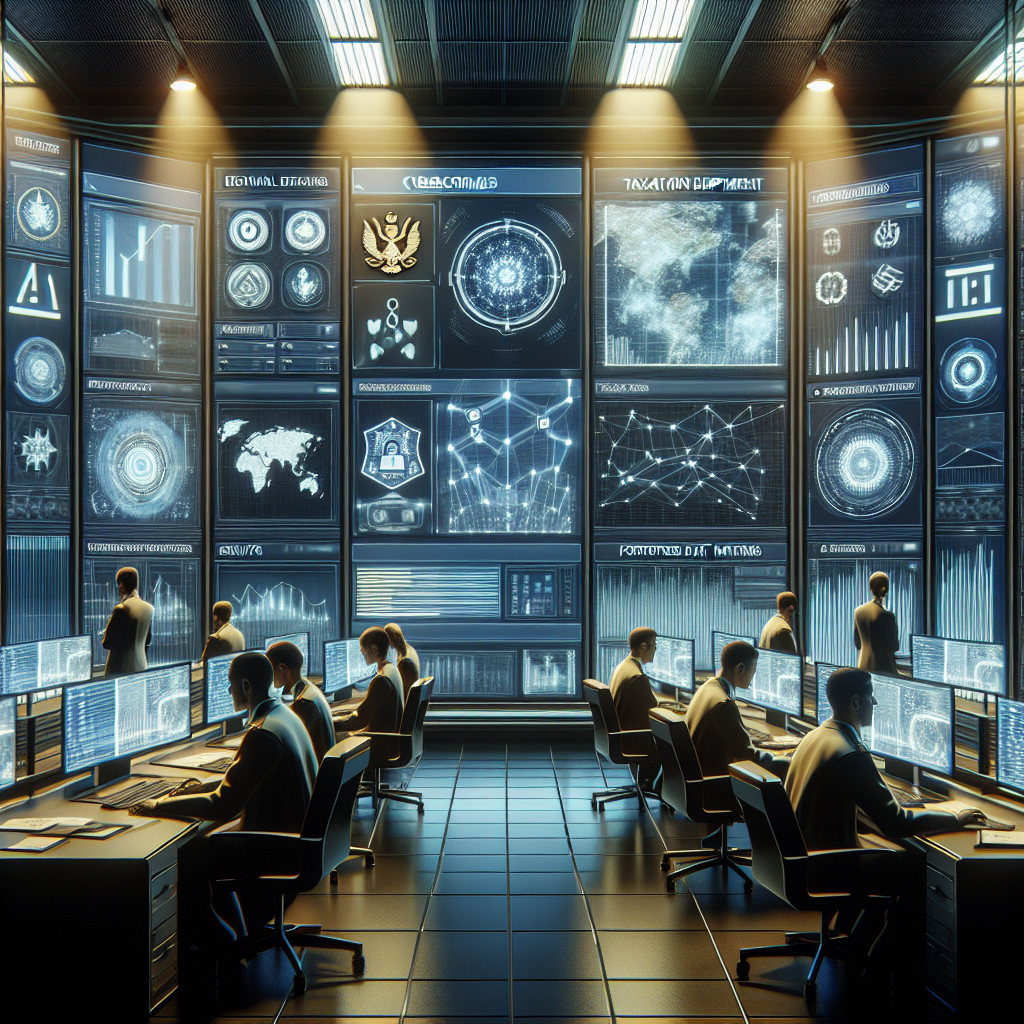

The Internal Revenue Service (IRS) has recently unveiled plans for a significant technological overhaul following startling revelations of widespread fraud within its systems. In a two-year span, the IRS identified approximately $21.1 billion in fraudulent claims, raising serious concerns about the integrity and efficiency of its operations. This blog post will delve into the details of the IRS’s findings, the implications for taxpayers, and the measures being taken to enhance the agency’s technological framework.

The Scope of the Fraud Problem

The discovery of $21.1 billion in fraudulent claims highlights a systemic issue within the IRS’s existing technological infrastructure. During the pandemic, many individuals and businesses turned to government relief programs for support, resulting in a rapid increase in claims. While these programs were intended to provide financial assistance, they inadvertently created opportunities for fraudsters to exploit weaknesses in the IRS’s processes.

Several factors contributed to the extent of the fraud:

- Rapid Implementation: Government relief programs were rolled out quickly to provide immediate assistance, which led to inadequate verification processes.

- Inadequate Technology: The IRS’s aging technology systems struggled to keep pace with the influx of claims, making it difficult to identify fraudulent submissions.

- Increased Targeting: Criminal organizations recognized the potential for profit and actively targeted these relief programs, leading to a surge in fraudulent claims.

IRS Response and Planned Overhaul

In light of these challenges, the IRS has committed to a comprehensive overhaul of its technological infrastructure. This initiative aims to modernize the agency’s systems and improve its ability to detect and prevent fraud.

Key aspects of the planned overhaul include:

- Investment in New Technology: The IRS plans to invest in advanced technology solutions, including artificial intelligence (AI) and machine learning (ML), to enhance fraud detection capabilities.

- Streamlining Processes: Simplifying and streamlining claims processing will reduce the opportunities for fraud to occur, making it harder for fraudulent claims to slip through the cracks.

- Enhanced Training: IRS staff will receive additional training to better understand the new technology and how to recognize potential fraud indicators effectively.

The Importance of Addressing Fraud

The need for the IRS to tackle fraud cannot be overstated. The financial implications are vast, not only for the agency but also for taxpayers as a whole. Fraudulent claims undermine the integrity of government programs designed to assist those in need. Additionally, the financial losses incurred by the IRS ultimately affect the taxpayer, as these losses can lead to increased tax rates or reduced services.

Addressing fraud is essential for several reasons:

- Restoring Trust: Enhancing the IRS’s ability to combat fraud restores public confidence in government programs.

- Protecting Resources: By reducing the occurrence of fraud, the IRS can allocate funds more effectively to support legitimate claims.

- Deterrent Effect: A robust fraud detection system serves as a deterrent to potential fraudsters, making it clear that the IRS is committed to combating fraudulent activity.

Future Implications for Taxpayers

As the IRS embarks on this technological overhaul, taxpayers can expect to see several changes in the way claims are processed and managed. While the transition may pose challenges in the short term, the long-term benefits are promising.

Here are some potential implications for taxpayers:

- Improved Processing Times: With enhanced technology and streamlined processes, taxpayers may experience shorter wait times for their claims to be processed.

- More Accurate Claim Management: Advanced systems will likely lead to fewer errors and faster identification of fraudulent claims, protecting legitimate taxpayers.

- Greater Transparency: Taxpayers can expect improved communication and transparency from the IRS regarding the status of their claims and any potential fraud investigations.

The Role of Cybersecurity

As the IRS modernizes its technology, cybersecurity will play a critical role in safeguarding sensitive taxpayer information. Cyber threats are ever-evolving, and the agency must remain vigilant in protecting its systems from breaches.

To mitigate cybersecurity risks, the IRS plans to:

- Enhance Security Protocols: Implementing stricter security measures will protect against unauthorized access to sensitive data.

- Regular Assessments: Conducting routine assessments of the agency’s systems will help identify vulnerabilities and areas for improvement.

- Collaboration with Experts: Partnering with cybersecurity experts will provide the IRS with insights into the latest threats and best practices for safeguarding information.

Conclusion

The IRS’s commitment to overhauling its technology in response to the alarming $21.1 billion in identified fraud marks a significant turning point for the agency. By investing in new technology, streamlining processes, and enhancing cybersecurity measures, the IRS aims to restore public trust and protect taxpayer resources.

As this overhaul progresses, it will be crucial for the IRS to communicate effectively with taxpayers and ensure that the transition is as smooth as possible. By prioritizing the fight against fraud, the IRS is taking important steps toward a more secure and efficient tax system, ultimately benefiting all taxpayers in the long run.

In this age of rapid technological advancement, it is essential that the IRS adapts and evolves to meet the challenges of fraud head-on, ensuring the integrity of its programs and the trust of the public.